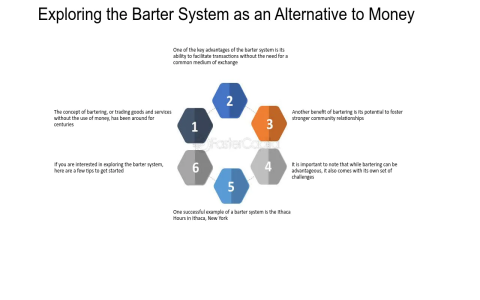

In the early stages of human civilization, bartering was the primary method of trade. Goods and services were exchanged directly, with no universal medium of exchange. However, over time, merchants and societies began to realize the inefficiencies of this system and adopted money as a more efficient and reliable means of conducting transactions. This transition, though gradual, fundamentally transformed the way people interacted in economic systems, shaping the course of history and laying the foundation for modern commerce.

The Limitations of Bartering

Bartering, while functional in small, close-knit communities, posed significant challenges as societies grew and economies became more complex. For instance, bartering relied on the “double coincidence of wants.” This meant that in order for a transaction to take place, both parties had to have something the other wanted. If one party had grain but needed tools, and the other had tools but needed livestock, the trade could never occur unless these needs perfectly matched. This situation made bartering highly inefficient, especially in larger markets or with diverse goods and services.

Moreover, bartering lacked a way to measure the value of goods consistently. How much grain was worth compared to a cow? Or a piece of pottery compared to a basket of apples? Without a standard measure of value, negotiations could become prolonged and contentious, ultimately leading to missed opportunities and the stalling of trade.

The Rise of Money as a Solution

As trade routes expanded and markets grew, merchants began to see the advantages of a more standardized system for exchange. Money, in the form of coins, became the perfect solution to the problems posed by bartering. Coins, often made from precious metals like gold or silver, offered a consistent and universally accepted medium of exchange. The emergence of money allowed merchants to easily assign and compare the value of goods, greatly simplifying transactions.

In addition to offering a reliable store of value, money introduced a concept of liquidity that bartering simply could not provide. It became possible for individuals to buy and sell goods without needing a direct exchange. A merchant could sell grain to one buyer, and with the proceeds, purchase livestock from another, all without needing to find someone who directly wanted grain in exchange for livestock. This greatly expanded the possibilities for trade, enabling more efficient and widespread commerce.

The Role of Money in Economic Growth

The decision to move away from bartering and adopt money as a standard of exchange marked a pivotal shift in human history. With money, merchants could now engage in trade across greater distances. This created the foundation for the growth of early economies, the development of cities, and the rise of sophisticated marketplaces. What had once been a local, fragmented system of exchange became a global, interconnected web of trade.

Furthermore, money allowed for the creation of credit, the accumulation of savings, and the growth of financial institutions. As merchants and consumers could now store wealth in the form of currency, they were able to make long-term investments in infrastructure, businesses, and technology, fueling the advancement of civilization.

A New Era of Trade and Commerce

The transition from bartering to using money did more than just streamline transactions—it fundamentally altered the way societies functioned. Money fostered the growth of markets, the spread of ideas, and the development of more advanced economies. With the ability to buy and sell goods with ease, societies became more connected, and resources were distributed more efficiently.

The introduction of money also paved the way for the creation of more complex economic systems, including taxation, trade agreements, and monetary policies that regulate supply and demand. These systems have been central to the modern global economy.

Conclusion

The decision to use money instead of bartering was not simply a shift in how goods were exchanged—it was a leap forward in human progress. Money solved the fundamental inefficiencies of bartering, allowing for more complex, efficient, and interconnected systems of trade and commerce. This evolution not only shaped the course of economic history but also laid the groundwork for the modern financial systems we rely on today.

By understanding the history of this shift, we gain insight into how human societies adapt to challenges and create solutions that drive progress. From the simple act of trading goods to the sophisticated global economies of today, money has played a central role in connecting people and driving innovation, making the world a smaller and more interconnected place.