When traders and investors hear the term “rally,” they often think of a market surge, a significant upward movement in asset prices that can seem both exhilarating and unpredictable. However, one question often arises in discussions around rallies: Does rally stabilize? In this article, we’ll dive deep into this question, examining the role of rallies in market dynamics and how they can impact stability for both short-term and long-term investors.

The Meaning of a Rally in Financial Markets

In simple terms, a rally refers to a period of sustained growth or upward movement in the price of assets, such as stocks, commodities, or indices. It’s typically driven by positive market sentiment, strong earnings reports, favorable economic news, or investor optimism. A rally can occur in various time frames, from short bursts lasting a few days to longer-term surges that span months or even years.

But when we ask, “Does rally stabilize?” we’re essentially probing whether these periods of growth create lasting stability or are merely temporary fluctuations that mask underlying volatility.

The Psychological Aspect of a Rally

Rallies often evoke strong psychological responses among traders. The excitement of seeing prices soar can cause a herd mentality, where investors rush to capitalize on the upward momentum. However, it’s important to recognize that rallies, while enticing, are often driven by speculative behavior rather than fundamentals. This means that while a rally may feel like a stabilizing force, it might be nothing more than a temporary spike before prices adjust or correct.

Does Rally Stabilize in the Long Term?

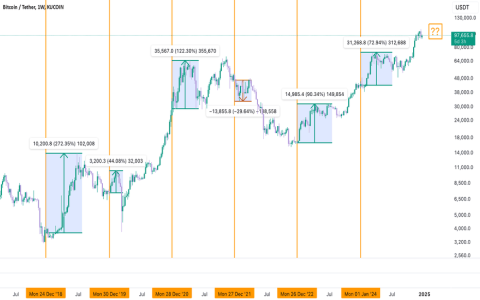

To determine if a rally leads to stabilization, we need to distinguish between short-term and long-term market movements. In the short term, rallies can create a sense of stability, especially when driven by positive news or strong earnings reports. For example, if a tech stock rallies due to a groundbreaking product release, the initial surge may lead to heightened investor confidence and a more stable price range in the following weeks or months.

However, the long-term stabilization of prices after a rally is much less certain. Market cycles are inherently volatile, and rallies often precede periods of correction or decline. In this context, a rally might not stabilize the market so much as it might artificially inflate prices before a more significant adjustment takes place.

Rallies as a Signal of Market Imbalance

A rally can sometimes be a signal that the market is out of balance, driven by short-term speculation rather than sustainable growth. For instance, the “dot-com bubble” of the late 1990s saw massive rallies in technology stocks, but those rallies were ultimately unsustainable, leading to a market crash in 2000.

This is why it’s crucial for investors to not only focus on the excitement of a rally but to assess whether the underlying fundamentals support the price growth. A rally that is not backed by solid fundamentals is more likely to result in instability than one that is grounded in long-term economic growth.

Factors That Affect Whether a Rally Stabilizes

– Economic Indicators: Strong GDP growth, low unemployment rates, and inflation control can lend credibility to a rally, helping to stabilize the market.

– Corporate Earnings: If the rally is driven by strong earnings reports and positive guidance from companies, there is a greater chance that stability will follow.

– Investor Sentiment: Investor optimism can help sustain a rally, but when that sentiment shifts, volatility can quickly re-enter the market.

– Global Events: Geopolitical tensions, natural disasters, or other global events can derail even the most promising rallies, causing instability instead of stabilization.

Conclusion: Does Rally Stabilize?

Ultimately, the question “Does rally stabilize?” is more complex than a simple yes or no. While a rally can provide temporary stability and boost market sentiment, its long-term effects on market stability depend largely on the underlying factors driving the rally. A rally fueled by genuine economic growth and investor confidence may help stabilize prices, but one driven by speculation and hype is more likely to cause a market correction in the future.

For traders and investors, it’s essential to be cautious during a rally. Relying too heavily on the perceived stability created by a rally can lead to missed opportunities or even significant losses when the market corrects itself. Understanding the dynamics behind a rally and analyzing market fundamentals will always be key to making informed decisions.

In conclusion, while rallies can create an illusion of stability, they do not always result in long-term market stabilization. Only time and careful analysis can reveal whether the momentum from a rally is sustainable or if it’s merely the calm before the storm.