In the fast-paced world of trading, having a comprehensive **Traders Guide Classified** can be the difference between success and failure. Whether you’re a seasoned trader or a novice looking to dive into the market, this guide is designed to equip you with essential insights, strategies, and tools to navigate the complex landscape of trading with confidence and precision. In this article, we’ll explore what makes a **Traders Guide Classified** so invaluable, how it can boost your trading journey, and why it should be an indispensable part of your strategy.

The Pillars of a Successful Trader’s Journey

A **Traders Guide Classified** isn’t just a collection of random tips; it’s a structured and curated resource that provides actionable advice and expert knowledge. Traders often face a daunting task of filtering through vast amounts of data, trends, and analyses. The **Traders Guide Classified** serves as a map, guiding traders through the noise and helping them make informed decisions.

# 1. **Understanding Market Basics: The Foundation of Trading**

For anyone starting their trading journey, the first step is to grasp the basic principles. A good **Traders Guide Classified** will introduce you to the fundamentals of different trading instruments such as stocks, commodities, forex, and cryptocurrencies. The guide will explain how these markets work, what drives market movements, and how to interpret different types of charts and indicators. It’s like learning the grammar before writing the novel of your trading career.

2. **Advanced Trading Strategies: Going Beyond the Basics**

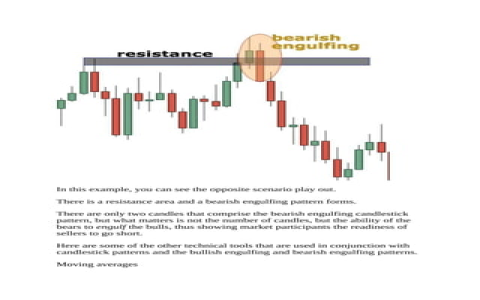

Once you’ve understood the basics, the next step is refining your skills with advanced trading strategies. A **Traders Guide Classified** will detail various trading strategies used by successful traders across different markets. From swing trading to day trading, and from trend-following strategies to contrarian methods, these guides break down each approach step by step.

Additionally, the guide might dive deep into sophisticated tools like technical analysis, fundamental analysis, and sentiment analysis. These are the equivalent of a trader’s toolkit, helping them to make data-driven decisions rather than emotional ones. Think of it as learning to use a scalpel instead of a blunt knife – precision is everything in the trading world.

3. **Risk Management: The Unseen Hero**

One of the most critical aspects of trading is risk management. Even the most skilled traders can face losses if they don’t manage their risks properly. A **Traders Guide Classified** will dedicate a significant portion to educating traders about the importance of setting stop losses, using proper position sizing, and diversifying their portfolios. Risk management is not just a precaution; it’s a mindset that every trader must cultivate.

The guide may also provide tips on how to avoid emotional trading, as fear and greed often lead to impulsive decisions that can result in significant losses. By practicing discipline and following a structured risk management plan, traders can protect their capital and ensure long-term success.

4. **Staying Up-to-Date with Market Trends**

In the dynamic world of trading, staying updated with market news and trends is crucial. A **Traders Guide Classified** will often include resources for tracking real-time market data, news outlets, and key financial reports. The guide might recommend tools like Bloomberg, Reuters, or even specialized trading platforms that offer real-time alerts on market movements.

The best traders don’t simply react to the market; they anticipate shifts and capitalize on emerging trends. A well-rounded guide will help you identify these trends early, whether in equities, commodities, or crypto, and adapt your trading strategy accordingly. Think of it as navigating through a storm; the more aware you are of the weather, the better your chances of sailing through unscathed.

5. **Building a Trading Plan: Your Roadmap to Success**

A **Traders Guide Classified** will often emphasize the importance of a trading plan. This is your personal blueprint for success. Without a trading plan, you’re essentially trading blind, reacting to market fluctuations instead of anticipating them. A detailed trading plan should include goals, risk tolerance, trading strategies, and entry/exit points. A well-constructed plan provides clarity and keeps emotions in check during times of uncertainty.

Think of the trading plan as your North Star. No matter how turbulent the market gets, it will keep you on track toward your ultimate goals.

Conclusion: Embrace the Knowledge and Transform Your Trading Game

The **Traders Guide Classified** isn’t just a guide; it’s a powerful resource that can transform your approach to trading. It’s not enough to have a basic understanding of the markets; success in trading requires a blend of strategic thinking, emotional discipline, and risk management. By leveraging the insights and strategies outlined in a **Traders Guide Classified**, traders can make informed decisions that set them up for long-term success.

In the end, trading isn’t about luck – it’s about understanding the market, managing risks, and executing strategies with precision. A solid guide provides the knowledge and structure needed to navigate this journey with confidence. So, whether you’re trading stocks, forex, or crypto, the right **Traders Guide Classified** can be your ultimate tool for unlocking success.